N.B. This article addresses the financial services industry, however, the insight and tips therein are applicable to nearly any industry today. ~EIC)

The financial services industry has always been characterized by its long list of compliance, risk, and regulatory requirements. Since the 2008 financial crisis, the industry is more regulated than ever, and as organizations undergo digital transformation and financial services customers continue to do their banking online, the myriad of compliance, risk, and regulatory requirements for financial institutions will only increase from here. In a related note, organizations are continuing to invest in their infrastructure to meet these requirements. IDC Financial Insights forecasts that the worldwide risk information technologies and services market will grow from $79 billion in 2015 to $96.3 billion in 2018.

All of this means reams of data. Financial firms by nature produce enormous amounts of data, and due to compliance requirements, must be able to store and maintain more data than ever before. McKinsey Global Institute reported in 2011 that the financial services industry has more digitally stored data than any other industry.

To succeed in todays financial industry, organizations need to take a cumulative, 3-part approach to their data:

1. Become masters at data management practices.

This appears obvious, but the vast amount of compliance, risk, and regulatory requirements necessitate that organizations become adept at data management. Capgemini identified 6 aspects to data management best practices:

Data Quality. Data should be kept optimal through periodic data review, and all standard dimensions of data quality– completeness, conformity, consistency, accuracy, duplication, and integrity must be demonstrated.

Data Structure. Financial services firms must decide whether their data structure should be layered or warehoused. Most prefer to warehouse data.

Data Governance. It is of upmost importance that financial firms implement a data governance system that includes a data governance officer that can own the data and monitor data sources and usage.

Data Lineage. To manage and secure data appropriately as it moves through the corporate network, it needs to be tracked to determine where it is and how it flows.

Data Integrity. Data must be maintained to assure accuracy and consistency over the entire lifecycle, and rules and procedures should be imposed within a database at the design stage.

Analytical Modeling. An analytical model is required to parcel out and derive relevant information for compliance.

2. Leverage risk, regulatory, and compliance data for business purposes.

There is a bright side to data overload; many organizations aren’t yet taking full advantage of the data they generate and collect. According to PWC, leading financial institutions are now beginning to explore the strategic possibilities of the risk, regulatory, and compliance data they own, as well as how to use insights from this data and analyses of it in order to reduce costs, improve operational efficiency, and drive revenue.

It’s understandable that in today’s business process of many financial institutions, the risk, regulatory, and compliance side of the organization do not actively collaborate with the sales and marketing teams. The tendency toward siloed structure and behavior in business make it difficult to reuse data across the organization. Certainly an organization can’t completely change overnight, but consider these tips below to help establish incremental change within your organization:

Cost Reduction: Eliminate the need for business units to collect data that the risk, regulatory, and compliance functions have already gathered, and reduce duplication of data between risk regulatory, compliance, and customer intelligence systems. Avoid wasted marketing expenses by carefully targeting marketing campaigns based upon an improved understanding of customer needs and preferences.

Increased Operational Efficiency: Centralize management of customer data across the organization. Establish a single source of truth to improve data accuracy. Eliminate duplicate activities in the middle and back office, and free resources to work on other revenue generating and value-add activities.

Drive Revenue: Customize products based upon enhanced knowledge of each customer’s risk profile and risk appetite. Identify new customer segments and potential new products through better understanding of customer patterns, preferences, and behaviors. Enable a more complete view of the customer to pursue cross-sell and up-sell oppportunities.

3. Implement a thorough analytics solution that provides actionable insight from your data.

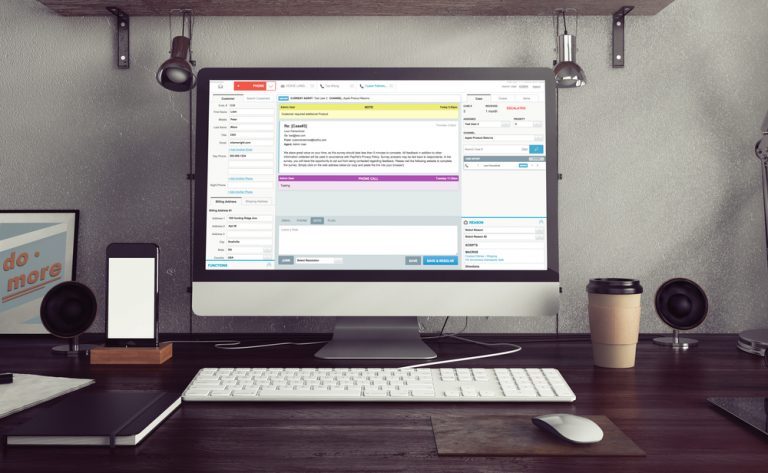

Today, it’s possible for financial organizations to implement an integrated Machine Learning component that runs in the background, that can ingest data of all types from any number of people, places, and platforms, intelligently normalize and restructure it so it is useful, run a dynamic series of actions based upon data type and whatever specified situations contexts your business process is in, and create dynamic BI data visualizations out-of-the-box.

Machine Learning Platforms like SYNAPTIK enable organizations to create wide and deep reporting, analytics and machine learning agents without being tied to expensive specific proprietary frameworks and templates, such as Tableau. SYNAPTIK allows for blending of internal and external data in order to produce new valuable insights. There’s no data modeling required to drop in 3rd party data sources, so it is even possible to create reporting and insight agents across data pools.