Private equity firms and hedge funds should be thriving in the age of information. With thousands of alternative data options, these companies can select which ones are most valuable for their business. However, many private equity firms and hedge funds do not rely on quantitative methods for assessing investment viability. According to the Financial Times, only 62% of hedge funds are investing in machine learning while only 54% are investing in big data initiatives. Should the almost 40% of hedge funds seek potential use cases for either, below are some examples:

Tracking industries

Tracking specific industries represents a major task for people within hedge funds and private equity firms. Hedge funds may have one person or a desk in charge of monitoring and forecasting specific items within an industry. Similarly, private equity funds may specialize in purchasing companies in specific industries such as retail or food service.

Tracking companies pre-purchase

The critical work of private equity funds is researching, bidding on and purchasing companies for their portfolio. To a lesser extent, hedge fund analysts want to monitor the success of certain companies prior to investment or divestment

Track sales

Tracking company sales can signal the health of specific companies. Hedge fund analysts will want to know the sales numbers and projections of the products under their watch. These numbers will likely include cyclical time series data. Perhaps more importantly, private equity firms who have already purchased companies need to monitor how their adjustments (if any) have affected total revenue.

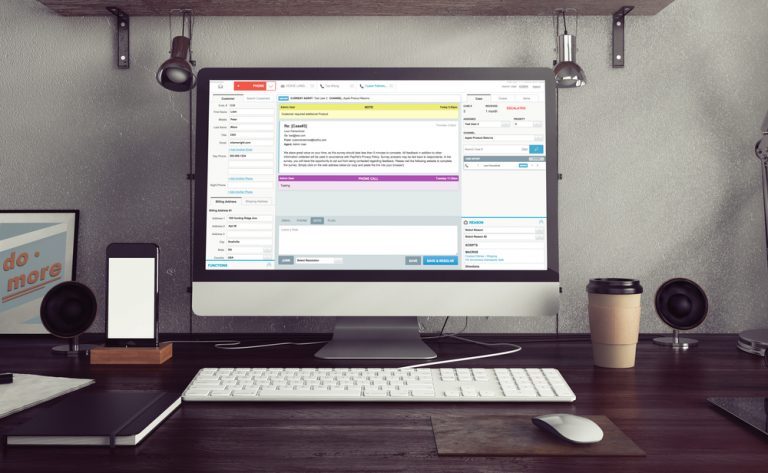

In summary, digitization use cases abound for hedge fund and private equity companies. These use cases include:

1.) Data ingest for millions of data points on companies and industries

2.) Analytics dashboards with visualization capabilities

3.) Data science analysis of industry and/or company data

4.) Low-code apps with user-friendly graphic user interfaces (GUIs) and backends storing proprietary algorithms

Synaptik, our data management and machine learning platform, is currently providing data ingest and management services to a billion-dollar hedge fund. Learn more about our process by contacting us at www.synaptik.co